1 min read

Chinese Golden week blank sailings

It is quite typical to observe blank sailings after holidays like China's Golden Week holiday and Chinese New Year when factories are closed and the...

Trans-Pacific Spot Rates plummeted by more than 10% in the last month.

Container shipping lines are facing tough times as peak season loses steam and spot rates plummet into loss-making territory. Alphaliner reports that rates are continuously declining due to insufficient demand and overcapacity. Linerlytica echoes this sentiment, stating that container market sentiment is deteriorating with little hope for a rate rebound in October. This is particularly concerning for ocean carrier Zim, which has a high spot exposure of 70% in the trans-Pacific this year.

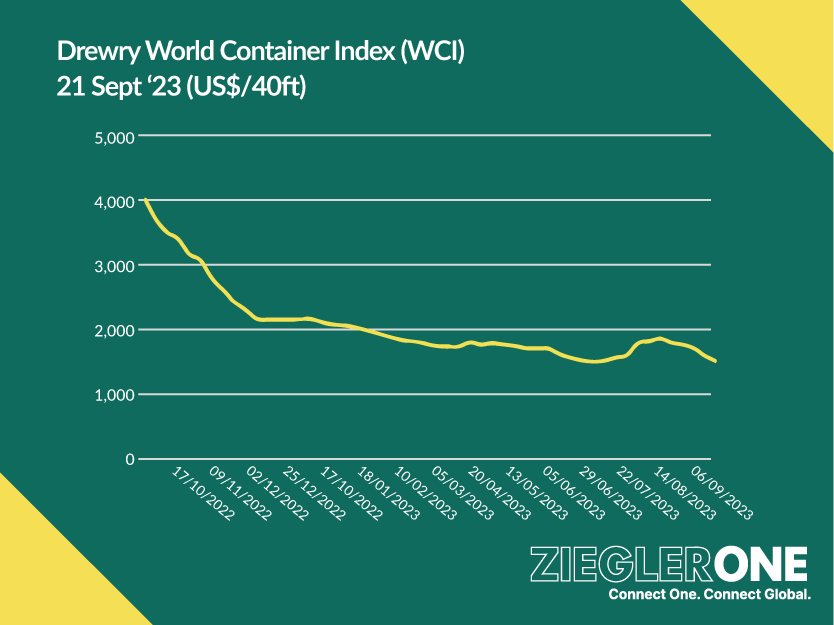

The downward trend of freight rates dates back to June 2023 when the LoadStar reported: “Financial prospects for the rest of the year remain generally highly uncertain for most carriers.” Read the June report here.

Declining rates for both the United States and Europe.

FBX spot assessment for the Asia-North America West Coast fell 16% to $1,712 per FEU, while the East Coast assessment dropped 13% to $2,662 per FEU in the past month.

Asia-Europe lanes are seeing double-digit pullbacks as well.

Lars Jensen, CEO of Vespucci Maritime, stated that spot rates in North Europe haven't been this low since early 2018, and to see sustained rates like this, we have to go back to late 2015 and early 2016. The Drewry World Container Index shows that European trades are faring worse than U.S. trades, with significant drops in spot prices from Shanghai to Rotterdam and Shanghai to Genoa.

Spot rates gravitate toward contract rates

In July and August, trans-Pacific spot rates exceeded annual contract rates, indicating a positive trend for ocean carriers. However, the premium of spot rates to contract rates in the Asia-East Coast trade has significantly decreased in the past month, based on data from Xeneta. On August 15, average short-term rates in this trade were $580 per FEU higher than average long-term rates.

However, the gap between short-term rates and long-term rates has significantly narrowed, with short-term rates now only $77 per FEU higher than long-term rates as of Thursday. It is worth noting that the spot-to-contract premium still remains substantial in the Asia-West Coast lane, standing at $283 per FEU.

Zim's Trans-Pacific Business: The Impact of Spot Rates

The deteriorating spot market in the Asia-East Coast trade is worrying for ocean carrier Zim, as it focuses on the trans-Pacific trade. Zim's decision to cease services to the U.S. West Coast and deploy newly constructed ships on the East Coast route is significant, as the Asia-East Coast market accounts for 34% of its total volume. With 70% of its trans-Pacific business on spot this year, Zim's caution was justified, as the latest index data suggests that its bet on the spot trade may turn negative.

View sources:

https://theloadstar.com/container-shipping-rates-collapse-is-the-word-says-xeneta/

1 min read

It is quite typical to observe blank sailings after holidays like China's Golden Week holiday and Chinese New Year when factories are closed and the...

CMA CGM announced a new service connecting the Far East and Kenya

As a Category 5 hurricane, Otis made its way to the coastal region near the breathtaking resort city of Acapulco on the southern Pacific Coast of...